California Tenants - NO MORE 60-DAY NOTICE TO TERMINATE TENANCY

The 60-day notice of termination requirement for month-to-month tenancies will be repealed at the end of this year. Effective January 1, 2006, residential landlords and property managers may give a 30-day Notice to Terminate to their month-to-month tenants (unless rent control or subsidized housing rules apply.

The 60-day rule was originally enacted in 2002 as a pilot project to help tenants who purportedly needed more time than the allotted 30 days to make new housing arrangements in a tight rental market. However, others said that length of time is too long for evicting problematic tenants. Many landlords and property managers prefer using a general 30-day notice to terminate, rather than the alternative 3-day notice to perform covenant or quit which may require litigation of issues such as noise, nuisances, or illegal activities by the tenant. Waiting 60 days rather than 30 days under those circumstances places an undue burden on landlords, property managers, and other tenants in the building. Please be sure to visit our Del Mar Encinitas real estate site. Also, a new site we are developing is: San Diego dentist Be sure to have a look.

Saturday, October 22, 2005

Thursday, October 20, 2005

Guess What - Real Estate to Remain Strong. Really?

With the demand for housing continuing to increase, U.S. home sales are expected to reach record levels by the end of 2005, according to the National Association of Realtors most recent forecast. Existing home sales in the U.S. are anticipated to rise 4.2 percent to 7.07 million units, while new home sales should reach 1.29 million units, a 7.1 percent increase from 2004. Additionally, total housing starts are expected to reach the highest level recorded since 1973 with a total of 2.04 million units. The added demand for housing stemming from the aftermath of Hurricane Katrina has pushed NAR's sales forecast even higher, according to the report."Short-term momentum is very strong, and our Pending Home Sales Index just set a record," said NAR Chief Economist David Lereah. "In addition to the housing needs of hurricane victims, we may be seeing some 'fence jumping' from homebuyers who are getting into the market before interests rates increase. Please visit our Del Mar real estate site.

Monday, October 17, 2005

Changes to Real Estate Tax Right-offs?

Last week, the President’s Advisory Panel on Tax Reform informally agreed that tax law should limit the home mortgage interest deduction to the interest paid on the first $300,000 or $350,000 of a mortgage. This is especially significant here in San Diego where mortgages are generally larger and where State lawmakers may follow any new Fed changes with new state taxes. The panel will issue its final recommendations on November 1. The panel is suggesting a transition period during which current homeowners could take advantage of laws as they existed when they bought their homes. Be sure to visit: San Diego real estate website, my San Diego for Sale by Owner real estate site and the new San Diego cosmetic surgery doctors directory.

Friday, October 14, 2005

Rates hit Six Month High!

(October 14, 2005) -- Freddie Mac reports a jump in the 30-year home loan rate to 6.03 percent from 5.98 percent during the past week, marking a six-month high. The one-year adjustable mortgage rate rose as well, climbing to a more than three-year high of 4.85 percent from 4.77 percent last week. Mortgage rates will continue to move upward due to soaring energy prices and concerns about inflation, making it more difficult for first-time buyers to achieve homeownership and less rewarding for adjustable-rate borrowers to switch to fixed-rate products. Freddie Mac chief economist Frank Nothaft believes the 30-year mortgage rate will hit 6.4 percent next year.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Bush sells Louisiana to France

President Bush and a giddy Jacques Chirac shake hands on the deal

BATON ROUGE, LA. - The White House announced today that President Bush has successfully sold the state of Louisiana back to the French at more than double its original selling price of $11,250,000.

"This is a bold step forward for America," said Bush. "And America will be stronger and better as a result. I stand here today in unity with French Prime Minister Jacques Chirac, who was so kind to accept my offer of Louisiana in exchange for 25 million dollars cash."

The state, ravaged by Hurricane Katrina, will cost hundreds of billions of dollars to rebuild.

"Jack understands full well that this one's a 'fixer upper,'" said Bush. "He and the French people are quite prepared to pump out all that water, and make Louisiana a decent place to live again. And they've got a lot of work to do. But Jack's assured me, if it's not right, they're going to fix it."

The move has been met with incredulity from the beleaguered residents of Louisiana.

"Shuba-pie!" said New Orleans resident Willis Babineaux.

"Frafer-perly yum kom drabby sham!"

However, President Bush's decision has been widely lauded by Republicans.

"This is an unexpected but brilliant move by the President," said Senate Majority Leader Bill Frist. "Instead of spending billions and billions, and billions of dollars rebuilding the state of Louisiana, we've just made 25 million dollars in pure profit.

""This is indeed a smart move," commented Fox News analyst Brit Hume. "Not only have we stopped the flooding in our own budget, we've made money on the deal. Plus, when the god-awful French are done fixing it up, we can easily invade and take it back again."

The money gained from "'The Louisiana Refund' is expected to be immediately pumped into the rebuilding of Iraq. .

Please be sure to visit our Del Mar Encinitas real estate site. Also, a new site we are developing is: San Diego dentist Be sure to have a look.

Monday, October 10, 2005

Interest Rates Moving Up!

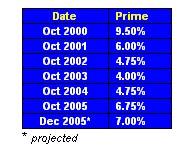

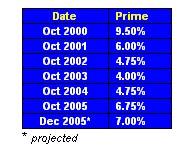

Prime is currently at 6.75%. Here’s how the Prime Rate has moved in the last five years:

So, rates are going up, gas is up, heating oil is up....real estate sales are moving DOWN!

So, rates are going up, gas is up, heating oil is up....real estate sales are moving DOWN!

Two new San Diego based sites of interest are: San Diego Vacation Attraction Tours and

Web site awards.

So, rates are going up, gas is up, heating oil is up....real estate sales are moving DOWN!

So, rates are going up, gas is up, heating oil is up....real estate sales are moving DOWN!Two new San Diego based sites of interest are: San Diego Vacation Attraction Tours and

Web site awards.

Thursday, October 06, 2005

Seniors & High Mortgage Debt

Seniors are increasingly reliant on housing wealth as a source of retirement savings, leading to a growing number of "house rich, income poor" households, according to a recent study by Harvard University's Joint Center for Housing Studies. After a decade of rising home values, residential real estate now represents the largest single asset class owned by seniors, while only 21.1 percent of households headed by individuals aged 65 and older own publicly traded stocks.Though homeownership boosts seniors' wealth accumulations, many retired people face unmanageable mortgage debt. Nearly 27 percent of seniors have not paid off their mortgages, and mortgage debt accounted for 70 percent of the total debt for homeowners aged 65 and older. According to the Center's study, seniors should take precautions when relying heavily on home equity for their retirement savings.

One solution is to develop new financial instruments, such as equity partners that purchase a share of the future interest in a home, to help seniors overcome financial burdens during retirement, according to the report.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

One solution is to develop new financial instruments, such as equity partners that purchase a share of the future interest in a home, to help seniors overcome financial burdens during retirement, according to the report.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Monday, October 03, 2005

Real Estate - Refinance Point Tax Saving Possible!

In a recent case brought before the United States Tax Court (Hurley 2005-125), the court ruled that the points paid for refinancing a property were tax deductible due to certain criteria being met by the Hurley’s. The case was brought to the Tax Court with the argument that the points paid for the home loan allowed the Hurley’s to obtain a lower rate, which resulted in a lower home loan payment. The monthly payment savings were in turn used for improvements to the property, including a new roof, carpet, and other repairs. Being that the Hurley’s provided documented proof of the improvements, the court ruled in their favor and allowed the points to be deducted from the Hurley’s taxes…all in the year the loan was refinanced.It is important to note that if you pay points to refinance a personal property, the points are only tax deductible if the refinance creates a lower home loan payment and the savings will be used for improvements to the property; or if the refinance transaction is being done to purchase an additional property. And as always, consult your mortgage and tax professional regarding your own specific situation to ensure that you meet the criteria needed for a deduction of this type.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Monday, September 26, 2005

Real Estate - Interest Rates Move Up!

READY…SET…HIKE! Fed Day came and went without much fanfare. Chairman Greenspan and his inflation-fighting friends at the Fed decided to hike up the Fed Funds Rate by another .25%, although the decision was not unanimous. More importantly, the commentary was fairly tame with no shockers for the market to absorb. Greenspan said that although the aftermath of Hurricane Katrina will be highly costly and inflationary, the long-term look at the economy shows that inflation is still “contained”. Sounds like you can bank on a few more hikes before Uncle Al turns over the keys to his successor…likely to be Fed Governor Ben Bernanke.

Although Mortgage Bonds and home loan rates had a bit of improvement early in the week, Friday saw them worsen right back to where they started as China announced they would allow further floating of their currency, the Yuan, against the US Dollar. Why? A few months back, China announced that they would no longer peg the Yuan to the US Dollar, and would instead allow it to float within a “limited range”. The breaking news that China will allow the Yuan to float even further from the Dollar means that China does not have to purchase as many US denominated securities – like Bonds – to keep the US Dollar at higher levels, which would in turn keep the Chinese Yuan stronger. Less buying is always bad news for prices…so Bonds and home loan rates took a turn for the worse on the news.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Although Mortgage Bonds and home loan rates had a bit of improvement early in the week, Friday saw them worsen right back to where they started as China announced they would allow further floating of their currency, the Yuan, against the US Dollar. Why? A few months back, China announced that they would no longer peg the Yuan to the US Dollar, and would instead allow it to float within a “limited range”. The breaking news that China will allow the Yuan to float even further from the Dollar means that China does not have to purchase as many US denominated securities – like Bonds – to keep the US Dollar at higher levels, which would in turn keep the Chinese Yuan stronger. Less buying is always bad news for prices…so Bonds and home loan rates took a turn for the worse on the news.

For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Friday, September 23, 2005

EZ Money

A Federal Reserve Survey found that non-traditional mortgages now account for “more than a quarter of new business at a third of the nation's largest home lenders.” Picture the economy and the housing market in two years. If you think it will be as good or better than we’ve seen in the last 3 years, you have taken the term “optimist” to a new level. Be sure to visit our free San Diego for sale by owner real estate site. Post text and photos for 90 days for Free!

Thursday, September 22, 2005

San Diego Real Estate - The run is OVER!

California Association of Realtors predicts ....

The rate of home price appreciation will moderate next year following four years of steep increases, while sales in 2006 will decline slightly from this year's record pace, according to C.A.R.'s "2006 Housing Market Forecast" released today. The forecast was presented during the C.A.R. Centennial REALTOR® EXPO, running from Sept. 20 - 22 at the San Diego Convention Center.The median home price in California will increase 10 percent to $575,500 in 2006 compared with a projected median of $523,150 this year, while sales for 2006 are projected to reach 630,610 units, falling 2 percent compared with 2005. The double-digit gain in the median price of a home, which California has experienced for most of the past five years, will again be fueled by the continuing shortage of housing across much of the state, according to C.A.R. economists. California typically gains nearly 250,000 new households, yet only will build about 200,000 new housing units this year, creating a shortfall of about 50,000 units."The economic fundamentals at both the state and national level continue to support a strong housing market in the Golden State for the foreseeable future," said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. "However, we also expect that the wave of new loan products that have flooded the market over the past several years have injected a higher level of risk into the market, while affordability barriers to homeownership will continue to push residents inland and even out of state."

The above is the official industry line. My take is California real estate is on the verge of a 20 to 40% DROP IN VALUE! For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

The rate of home price appreciation will moderate next year following four years of steep increases, while sales in 2006 will decline slightly from this year's record pace, according to C.A.R.'s "2006 Housing Market Forecast" released today. The forecast was presented during the C.A.R. Centennial REALTOR® EXPO, running from Sept. 20 - 22 at the San Diego Convention Center.The median home price in California will increase 10 percent to $575,500 in 2006 compared with a projected median of $523,150 this year, while sales for 2006 are projected to reach 630,610 units, falling 2 percent compared with 2005. The double-digit gain in the median price of a home, which California has experienced for most of the past five years, will again be fueled by the continuing shortage of housing across much of the state, according to C.A.R. economists. California typically gains nearly 250,000 new households, yet only will build about 200,000 new housing units this year, creating a shortfall of about 50,000 units."The economic fundamentals at both the state and national level continue to support a strong housing market in the Golden State for the foreseeable future," said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. "However, we also expect that the wave of new loan products that have flooded the market over the past several years have injected a higher level of risk into the market, while affordability barriers to homeownership will continue to push residents inland and even out of state."

The above is the official industry line. My take is California real estate is on the verge of a 20 to 40% DROP IN VALUE! For the best in San Diego real estate websites, please visit: San Diego real estate - San Diego downtown condos - Costal Del Mar La Jolla real estate - San Diego for sale by owner. Also, for any legal assistance, visit San Diego attorneys Directory. Another new San Diego site is all about web site awards. Add a little prestige & additional creditability to your web site ( if it qualifies) with one of these excellent web awards. Their newest is a very cool blog award. Visit the site at: www.web-site-award-winning.com

Tuesday, September 20, 2005

EZ Money - Hard Times Sure to Follow

A Federal Reserve Survey found that non-traditional mortgages now account for “more than a quarter of new business at a third of the nation's largest home lenders.” Picture the economy and the housing market in two years. If you think it will be as good or better than we’ve seen in the last 3 years, you have taken the term “optimist” to a new level.

Be sure to visit our free San Diego for sale by owner real estate site. Post text and photos for 90 days for Free!

Be sure to visit our free San Diego for sale by owner real estate site. Post text and photos for 90 days for Free!

Subscribe to:

Comments (Atom)